A looming recession in the United States has been the subject of much speculation and concern in recent months. Many experts have predicted that the economy is headed for a downturn, and the National Association for Business Economics (NABE) conducted a survey of 48 economists to gauge their predictions.

According to the survey, 58% of respondents anticipate a recession sometime this year, which is the same percentage as in the NABE’s December survey. However, only a quarter of economists think that a recession will have begun by the end of March, compared to half who believed so in December.

The survey reflects responses from economists in businesses, trade associations, and academia, and was released on Monday. A third of the economists who responded to the survey now expect a recession to begin in the April-June quarter, with one-fifth anticipating it will start in the July-September quarter.

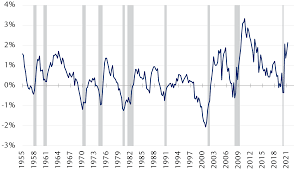

This delay in economists’ expectations for a downturn to begin follows a series of government reports that suggest the economy remains robust, despite the Federal Reserve raising interest rates eight times in an effort to slow growth and curb high inflation.

For instance, in January, employers added more than half a million jobs, and the unemployment rate reached its lowest level since 1969 at 3.4%. Sales at retail stores and restaurants also rose 3%, the sharpest monthly gain in nearly two years. These data points suggest that consumers feel financially secure and are willing to spend, which drives most of the economy’s growth.

Despite these positive signs, inflation rose sharply in January, after weakening for several months, raising concerns that the Federal Reserve may raise its benchmark rate higher than expected. Such an action would make mortgages, auto loans, and credit card borrowing more expensive, causing interest rates on business loans to also rise. Such tighter credit conditions can weaken the economy and even cause a recession.

The findings of the survey are in line with a growing sense of cautious optimism among some economists. Many believe that although there are risks and uncertainties, the U.S. economy remains fundamentally sound. Nevertheless, others caution that a recession is likely at some point in the near future.

The uncertainty surrounding the economy has been compounded by a number of global factors. The ongoing trade war between the United States and China, for instance, has led to increased tariffs on a variety of goods, causing prices to rise and potentially slowing economic growth.

Additionally, Brexit, the United Kingdom’s impending departure from the European Union, has led to uncertainty and instability in financial markets.

Despite these challenges, the U.S. economy has remained resilient in recent months. The Federal Reserve’s decision to raise interest rates has been seen as a necessary step to curb inflation and prevent the economy from overheating. Inflation, however, remains a concern, and the Federal Reserve will need to be vigilant in order to prevent prices from rising too quickly.

Furthermore, the impact of the recent tax cuts on the economy remains a subject of debate. While some economists argue that the tax cuts will provide a boost to economic growth, others caution that the benefits may be short-lived and could contribute to rising deficits and debt.

Regardless of the uncertainties facing the U.S. economy, it is clear that policymakers must remain vigilant in order to ensure that the economy remains stable and healthy. In addition to monitoring inflation and interest rates, policymakers must also be mindful of the impact of global events on the U.S. economy.

The ongoing trade war with China, for instance, has already had a significant impact on the economy, and policymakers must be prepared to address these challenges in a timely and effective manner.

In conclusion, while the majority of business economists expect a recession to occur later this year, the timing remains uncertain, and there are both positive and negative indicators. Regardless, it is essential that policymakers remain vigilant and act accordingly to ensure that the economy remains stable and healthy.