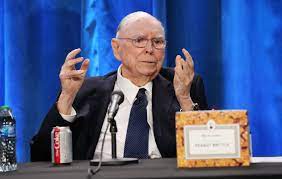

Charlie Munger, the 99-year-old Vice Chairman of Berkshire Hathaway, has called for the United States government to ban cryptocurrencies, following China’s lead, arguing that a lack of regulation has enabled reckless behavior and a gambling mentality.

Munger penned an op-ed in The Wall Street Journal, in which he stated that “a cryptocurrency is not a currency, not a commodity, and not a security,” and instead is a “gambling contract with a nearly 100% edge for the house.”

Munger’s stance on cryptocurrencies is in line with that of his long-time business partner, Warren Buffett. Both have been vocal critics of cryptocurrencies, asserting that they are not tangible or productive assets.

Munger’s comments come at a time when the cryptocurrency industry has been facing a series of challenges, including failed projects, a liquidity crunch, and the collapse of FTX, once one of the world’s largest exchanges.

According to Coin Metrics, the cryptocurrency market lost more than $2 trillion in value last year. Bitcoin, the world’s largest cryptocurrency, saw its price fall 65% in 2022 before rebounding around 40% to trade around $23,824.

Munger believes that in recent years, privately owned companies have issued thousands of new cryptocurrencies that have become publicly traded without any governmental pre-approval or disclosures. Some have been sold to promoters for almost nothing, after which the public buys in at much higher prices without fully understanding the “pre-dilution in favor of the promoter.”

Munger listed two “interesting precedents” that he believes could guide the U.S. to take action. First, China has strictly prohibited services offering trading, order matching, token issuance, and derivatives for virtual currencies. Second, from the early 1700s, the English Parliament banned all public trading in new common stocks and kept this ban in place for about 100 years.

“What should the U.S. do after a ban on cryptocurrencies is in place? Well, one more action might make sense: Thank the Chinese communist leader for his splendid example of uncommon sense,” Munger wrote.

Munger’s opinion has been met with mixed reactions. Some have praised his call for regulation, arguing that the cryptocurrency market is in dire need of proper governance.

However, others have criticized his stance, stating that cryptocurrencies are here to stay and that they will continue to play a significant role in the future of finance.

The debate over the regulation of cryptocurrencies is far from over, and it remains to be seen whether Munger’s call for a ban will be heeded by the U.S. government.

For now, Munger’s op-ed serves as a reminder of the controversy surrounding cryptocurrencies and the need for careful consideration when it comes to their regulation.